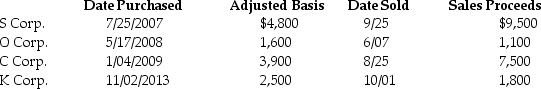

Mike sold the following shares of stock in 2014:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Definitions:

Associative Learning

A learning process by which an association is formed between two stimuli or a behavior and a stimulus.

Classical Conditioning

A teaching mechanism where a response initially caused by a secondary stimulus becomes triggered by the primary stimulus after repeated pairings of the two stimuli.

Behavior Manipulation

Techniques used to influence or control individuals' behavior for specific purposes, which can range from marketing strategies to psychological therapies.

Coordinated Repetition

A strategy involving the consistent and coordinated repetition of marketing messages across different media and platforms.

Q8: Which of the following statements about the

Q13: Liz,who is single,lives in a single family

Q27: Josh purchases a personal residence for $278,000

Q27: Discuss the timing of the allowable medical

Q45: Discuss briefly the options available for avoiding

Q58: Jack exchanged land with an adjusted basis

Q79: Trista,a taxpayer in the 33% marginal tax

Q84: On April 1,Delta Corporation distributes $120,000 in

Q120: Kendrick,who has a 35% marginal tax rate,had

Q124: Discuss the estimated tax filing requirements for