MrAnd MrsThibodeaux,who Are Filing a Joint Return,have Adjusted Gross Income of of $75,000.During

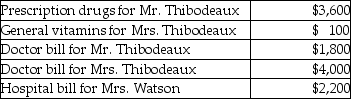

Mr.and Mrs.Thibodeaux,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Prices In Resource Markets

The costs associated with purchasing inputs like labor, land, and capital in markets where they are traded.

Relative Scarcity

The condition where the availability of resources is limited compared to the unlimited wants and needs.

Demand For Resource

The desire and willingness of firms or individuals to acquire resources at various price levels.

Resource

Refers to assets or inputs used in the production of goods and services, such as time, money, or raw materials.

Q17: If a loss is disallowed under Section

Q37: Which of the following is not reported

Q37: Sandy,a cash method of accounting taxpayer,has a

Q38: Becky places five-year property in service during

Q47: On July 25,2013,Karen gives stock with a

Q51: Tax attributes of the target corporation are

Q69: Andrea died with an unused capital loss

Q73: Table Corporation transfers one-half of its assets

Q77: Richard exchanges a building with a basis

Q96: During the current year,Tony purchased new car