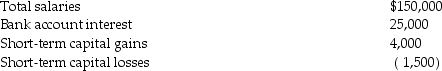

During 2014 Richard and Denisa,who are married and have two dependent children,have the following income and losses:

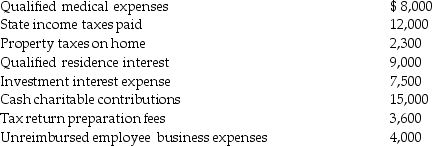

They also incurred the following expenses:

They also incurred the following expenses:

Compute Richard and Denisa's taxable income for the year.(Show all calculations in good form.)

Compute Richard and Denisa's taxable income for the year.(Show all calculations in good form.)

Definitions:

Facilitator

An individual who makes an action or process easier or assists in the progress of discussions and processes within a group.

Supervisor

An individual who oversees and manages the work of others, typically in a professional or work setting.

Participant

An individual who takes part in an activity or event, often used in the context of research, workshops, or group processes.

Formal Group

An officially recognized collective that is supported by the organization.

Q15: Ellie,a CPA,incurred the following deductible education expenses

Q34: Alto and Bass Corporations have filed consolidated

Q60: Martha,an accrual-method taxpayer,has an accounting practice.In 2013,she

Q62: Joseph has AGI of $170,000 before considering

Q62: Tyne is a 48-year-old an unmarried taxpayer

Q73: Are liquidation and dissolution the same? Explain

Q86: Identify which of the following statements is

Q89: Adam owns interests in partnerships A and

Q96: Clayton contributes land to the American Red

Q124: Gabby owns and operates a part-time art