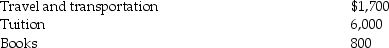

Ellie,a CPA,incurred the following deductible education expenses to maintain or improve her skills:

Ellie's AGI for the year is $60,000.

Ellie's AGI for the year is $60,000.

a.If Ellie is self-employed,what are the amount of and the nature of the deduction for these expenses?

b.If,instead,Ellie is an employee who is not reimbursed by his employer,what are the amount of and the nature of the deduction for these expenses (after limitations)?

Definitions:

Alcoholics Anonymous

Alcoholics Anonymous is an international fellowship of individuals who have a drinking problem, offering mutual support to recover from alcoholism through a 12-step program.

Psychological Approach

A perspective in psychology that emphasizes understanding mental processes, experiences, and behaviors through research and theory.

Complete Abstinence

The act of entirely refraining from using or consuming a particular substance or engaging in a specific behavior.

Controlled Drinking

A harm reduction approach that involves managing one's alcohol intake to minimize its harmful effects rather than abstaining completely.

Q8: Kyle sold land on the installment basis

Q15: After the stock acquisition,MCI transferred its assets

Q20: A loss on business or investment property

Q21: David sells his one-third partnership interest to

Q26: The sale of a partnership interest always

Q37: Which of the following is not reported

Q46: Cardinal and Bluebird Corporations both use a

Q54: Identify which of the following statements is

Q69: When business property involved in a casualty

Q112: For purposes of applying the passive loss