Multiple Choice

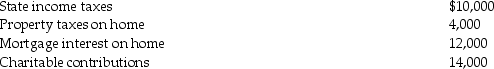

Tasneem,a single taxpayer has paid the following amounts in 2014:  Tasneem's AGI is $360,000.What is her net itemized deduction allowed?

Tasneem's AGI is $360,000.What is her net itemized deduction allowed?

Comprehend how the presence of simple effects influences the interpretation of main effects within a factorial research design.

Gain knowledge in calculating various statistical measures, such as R^2, SSA, SSB, and SST, and interpret their significance in research.

Grasp the concept of F-ratio statistics and the significance of between-group and within-group variance.

Understand the role and procedural implementation of factorial research designs, including their ability to analyze multiple variables simultaneously.

Definitions:

Related Questions

Q2: Melanie,a single taxpayer,has AGI of $220,000 which

Q32: Aretha has AGI of less than $100,000

Q46: In 2014,Carlos filed his 2013 state income

Q62: Which of the following is not an

Q65: Intercompany sales between members of an affiliated

Q86: On the first day of the partnership's

Q89: Penish and Sagen Corporations have filed consolidated

Q98: Teri pays the following interest expenses during

Q109: All of the following are capital assets

Q128: Taxpayers may deduct legal fees incurred in