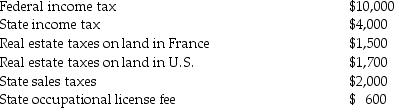

During the current year,Deborah Baronne,a single individual,paid the following amounts:

How much can Deborah deduct in taxes as itemized deductions?

How much can Deborah deduct in taxes as itemized deductions?

Definitions:

Feature Article

A detailed piece of writing on a particular subject that provides in-depth analysis, information, and insights, often found in magazines or newspapers.

Company Event

A company event is an organized gathering sponsored by a business for its employees, clients, or stakeholders, often for networking, marketing, or celebratory purposes.

IMC

Integrated Marketing Communications, a strategic approach that integrates various promotional tools and channels to provide clarity, consistency, and maximum communication impact.

Mass Television Advertising

A marketing approach that involves broadcasting promotional messages to a broad audience through television media.

Q5: Identify which of the following statements is

Q6: A taxpayer may deduct suspended losses of

Q21: What are arguments for and against preferential

Q28: Identify which of the following statements is

Q31: The following information is reported by Acme

Q35: Abby owns a condominium in the Great

Q63: Martin Corporation granted a nonqualified stock option

Q94: Fines and penalties are tax deductible if

Q99: When computing the accumulated earnings tax,which of

Q118: Mike sold the following shares of stock