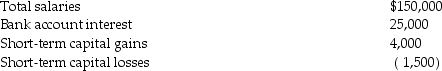

During 2014 Richard and Denisa,who are married and have two dependent children,have the following income and losses:

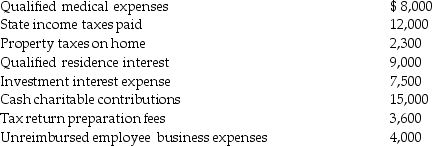

They also incurred the following expenses:

They also incurred the following expenses:

Compute Richard and Denisa's taxable income for the year.(Show all calculations in good form.)

Compute Richard and Denisa's taxable income for the year.(Show all calculations in good form.)

Definitions:

Cross-pollination

The transfer of pollen from the anther of a flower of one plant to the stigma of a flower of another plant, promoting genetic diversity.

Pollen Grain

In seed plants, structure that is derived from a microspore and develops into a male gametophyte.

Polar Nucleus

In plants, one of the two nuclei that migrate to the center of the embryo sac and fuse with a sperm nucleus during fertilization, contributing to the endosperm's development.

Sperm Nucleus

The male genetic material contained within the head of a sperm cell that fuses with an egg cell's nucleus during fertilization.

Q2: Brad exchanges 1,000 shares of Goodyear Corporation

Q23: Mario contributes inventory to a partnership on

Q53: Expenses are deductible only if connected to

Q68: Rajiv,a self-employed consultant,drove his auto 20,000 miles

Q73: Acquisition indebtedness for a personal residence includes

Q75: The vacation home limitations of Section 280A

Q75: Brown Corporation has assets with a $650,000

Q81: A taxpayer suffers a casualty loss on

Q91: Taxpayers are allowed to recognize net passive

Q117: Kim currently lives in Buffalo and works