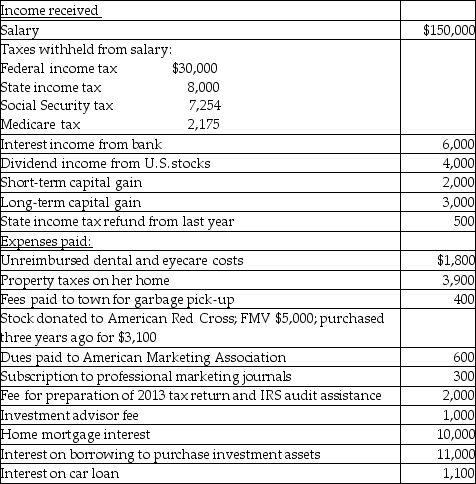

Hope is a marketing manager at a local company. Information about her 2014 income and expenses is as follows:

Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single,and she elects to itemize her deductions each year.Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Compute Hope's taxable income for the year in good form. Show all supporting computations. Hope is single,and she elects to itemize her deductions each year.Assume she does not make any elections regarding the investment interest expense. Also assume that her tax profile was similar in the preceding year.

Definitions:

Change-Of-Shift Report

Report usually given to nurses starting the next shift.

Chest X-Ray

A Chest X-Ray is a diagnostic imaging test that uses X-rays to visualize the chest's interior, including the lungs, heart, and bones, to detect abnormalities or diseases.

Vital Signs

Basic physiological measurements of function that include body temperature, pulse rate, respiration rate, and blood pressure.

SOAP Charting

A method of documentation employed by health care providers to write out notes in a patient's chart, including Subjective, Objective, Assessment, and Plan.

Q37: Chelsea,who is self-employed,drove her automobile a total

Q45: The personal holding company tax might be

Q47: Which of the following statements is incorrect

Q61: Acme Corporation acquires Fisher Corporation's assets in

Q64: A closely held C Corporation's passive losses

Q64: Emma Grace acquires three machines for $80,000,which

Q81: Which of following generally does not indicate

Q86: Blair and Cannon Corporations are the two

Q95: The deduction for unreimbursed transportation expenses for

Q108: Martin Corporation granted an incentive stock option