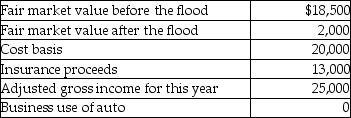

A flood damaged an auto owned by Mr.and Mrs.South on June 15 of this year.The car was only used for personal purposes.  Based on these facts,what is the amount of the South's casualty loss deduction after limitations for this year?

Based on these facts,what is the amount of the South's casualty loss deduction after limitations for this year?

Definitions:

Robert Gagné

Robert Gagné was an American educational psychologist best known for his "Conditions of Learning" theory, which emphasizes the different levels and types of learning and the importance of sequencing instruction appropriately.

High-Involvement

An approach or strategy where employees are deeply engaged and participate in decision-making, problem-solving, and other aspects of organizational performance.

Lecture Format

A traditional method of instruction where an educator delivers a presentation to a large audience primarily in a one-way communication mode.

Lesson Plan Cover Page

The first page of a lesson plan document, typically including such details as the lesson title, date, teacher's name, and objective overview.

Q2: On January 1,Helmut pays $2,000 for a

Q5: Explain the requirements a group of corporations

Q16: A contributor may make a deductible contribution

Q24: Generally,Section 267 requires that the deduction of

Q38: In order for a taxpayer to deduct

Q38: Identify which of the following statements is

Q56: Determine the net deductible casualty loss on

Q77: Sarah incurred employee business expenses of $5,000

Q95: The deduction for unreimbursed transportation expenses for

Q102: In computing the ordinary income of a