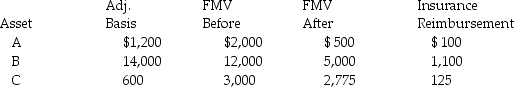

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2014 and the following occurred:

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Nursing Care Plan

A documented process by which nurses assess patients' needs, plan and implement specific interventions, and evaluate the outcomes, aimed at achieving patient care goals.

Evaluative Measures

Tools or methods used to assess the effectiveness or impact of a program, treatment, or intervention.

Respiratory Rate

The number of breaths a person takes per minute, a vital sign used to assess respiratory function and general health.

Wound Healing

The physiological process by which the body repairs and regenerates tissue damage, involving a series of coordinated stages including hemostasis, inflammation, proliferation, and maturation.

Q9: Identify which of the following statements is

Q15: In the current year,Marcus reports the following

Q19: Why would a taxpayer elect to use

Q30: Parent and Subsidiary Corporations form an affiliated

Q41: In 2013 Grace loaned her friend Paula

Q44: In-home office expenses for an office used

Q54: Leo spent $6,600 to construct an entrance

Q55: What are the five steps in calculating

Q82: Mary and Martha,who had been friends for

Q93: Jarrett owns a mountain chalet that he