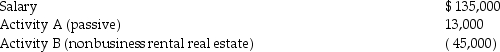

Parveen is married and files a joint return.He reports the following items of income and loss for the year:

If Parveen actively participates in the management of Activity B,what is his AGI for the year and what is the passive loss carryover to next year?

If Parveen actively participates in the management of Activity B,what is his AGI for the year and what is the passive loss carryover to next year?

Definitions:

Autoeroticism

Sexual gratification achieved alone, often through masturbation or fantasizing, without the participation of a sexual partner.

Autofellatio

A sexual act where a male performs oral sex on himself.

Masturbation

The stimulation of one’s own genitals.

Least Prevalent

Refers to the lowest occurrence or frequency of a condition, behavior, or phenomenon within a specific population.

Q3: Jorge owns activity X which produced a

Q5: Explain the requirements a group of corporations

Q15: In March of the current year,Marcus began

Q16: A contributor may make a deductible contribution

Q62: Joseph has AGI of $170,000 before considering

Q67: An employer receives an immediate tax deduction

Q76: Sarah purchased a new car at the

Q80: Carly owns 25% of Base Corporation's single

Q85: Mara owns an activity with suspended passive

Q107: Which of the following is not required