Multiple Choice

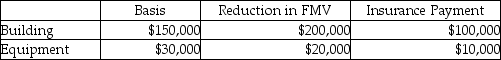

Lena owns a restaurant which was damaged by a tornado.The following assets were partially destroyed:  Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

Lena has AGI of $50,000.What is the amount of Lena's deductible casualty loss?

Understand and apply various gas laws (Boyle's, Charles', and the Combined Gas Law) to solve problems related to the behavior of gases under different conditions.

Understand the concept of isomers and their relevance to chemicals like TNT.

Identify instruments used in the analysis of substances like TNT.

Comprehend the operational principles of walk-through airport explosive detectors.

Definitions:

Related Questions

Q6: Diane,a successful accountant with an annual income

Q10: Galaxy Corporation purchases specialty software from a

Q23: Blair and Cannon Corporations are members of

Q52: Jason,a lawyer,provided legal services for the employees

Q54: Employees receiving nonqualified stock options recognize ordinary

Q56: What is the treatment of charitable contributions

Q65: Intercompany sales between members of an affiliated

Q66: Parent Corporation owns all of the stock

Q84: Daniel has accepted a new job and

Q109: Carl purchased a machine for use in