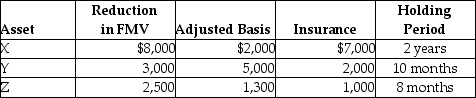

In the current year,Marcus reports the following casualty gains and losses on personal-use property.Assets X and Y are destroyed in the first casualty while Z is destroyed in a second casualty.  As a result of these losses and insurance recoveries,Marcus must report

As a result of these losses and insurance recoveries,Marcus must report

Definitions:

Fight or Flight

A physiological response to perceived threat or harm, preparing the body to either confront or avoid danger.

Positive Subjective Experiences

Personal experiences that evoke good feelings, satisfaction, or pleasure.

Sensual Pleasures

Enjoyments derived from gratifying sensory experiences, often related to touch, taste, smell, sound, and sight.

Present

The current moment or period of time, distinct from the past and future.

Q12: Lake Corporation distributes a building used in

Q15: Ellie,a CPA,incurred the following deductible education expenses

Q21: When personal-use property is covered by insurance,no

Q47: In October 2014,Jonathon Remodeling Co.,an accrual-method taxpayer,remodels

Q50: Ilene owns an unincorporated manufacturing business.In 2014,she

Q54: Identify which of the following statements is

Q94: One of the requirements which must be

Q97: What types of corporations are not includible

Q99: New York Corporation adopts a plan of

Q107: A taxpayer guarantees another person's obligation and