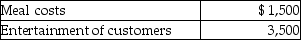

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

Unions

Organizations formed by workers to protect their rights and interests, often engaging in collective bargaining with employers.

International Trade Union Confederation

A global organization that brings together national trade unions from various countries to promote workers' rights and interests internationally.

Main Objectives

The primary goals or aims that an individual, organization, or project seeks to achieve.

European Union

A political and economic union of 27 European countries that are located primarily in Europe, aiming to promote peace, establish a unified market, ensure the free movement of people, goods, services, and capital, enact legislation in justice and home affairs, and maintain common policies on trade, agriculture, fisheries, and regional development.

Q4: A new partner,Gary,contributes cash and assumes a

Q25: Which of the following is not generally

Q25: Bud has devoted his life to his

Q55: A taxpayer who uses the cash method

Q70: Kendal reports the following income and loss:<br>

Q87: On July 25 of this year,Raj sold

Q88: Hunter retired last year and will receive

Q98: Boxcar Corporation and Sidecar Corporation,an affiliated group,reports

Q102: Eicho's interest in the DPQ Partnership is

Q106: A partnership has one general partner,Allen,who materially