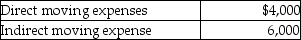

Edward incurs the following moving expenses:  The employer reimburses Edward for the full $10,000.What is the amount to be reported as income by Edward?

The employer reimburses Edward for the full $10,000.What is the amount to be reported as income by Edward?

Definitions:

Dividends

Payments made by a corporation to its shareholder members, distributing a portion of the company's earnings.

FIFO System

First In, First Out, an inventory valuation method where the costs of the oldest inventory items are the first to be expensed.

Goodwill

The intangible asset that arises when a company acquires another business for more than the fair value of its net assets.

Impairment

The permanent reduction in the value of a company's asset, typically when the asset's market value drops below its recorded book value.

Q22: According to the IRS,a person's tax home

Q28: Mr.and Mrs.Thibodeaux,who are filing a joint return,have

Q39: Parent Corporation sells land (a capital asset)to

Q48: Bert,a self-employed attorney,is considering either purchasing or

Q55: Patrick purchased a one-third interest in the

Q77: Dinia has agreed to provide services valued

Q78: Emma,a single taxpayer,obtains permission to change from

Q92: A partnership plans to set up a

Q95: Taxpayers may not deduct interest expense on

Q98: Explain when educational expenses are deductible for