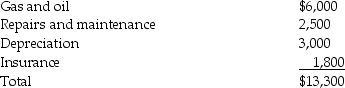

Sarah purchased a new car at the beginning of the year. She makes an adequate accounting to her employer and receives a $2,400 (12,000 miles × 20 cents per mile)reimbursement in 2014 for employment-related business miles.She incurs the following expenses related to both business and personal use:

She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

What are the possible amounts of Sarah's deductible transportation expenses?

Definitions:

Ranges

In the context of appliances, refers to kitchen stoves that combine a cooktop with an oven; in broader use, can mean a variety of distances or scopes.

Forecasting Risk

The potential for actual outcomes to vary significantly from the predictions or expectations due to changes in variables or conditions.

Replacement

The act of substituting a new asset or item for an old or damaged one.

Internal Rate

Often referring to the internal rate of return (IRR), which is the rate of growth a project is expected to generate, calculated as the rate of discount that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

Q38: What conditions are required for a partner

Q51: What is the tax impact of guaranteed

Q54: Identify which of the following statements is

Q60: Formation of a partnership requires legal documentation

Q62: Identify which of the following statements is

Q86: Blair and Cannon Corporations are the two

Q93: Identify which of the following statements is

Q101: The WE Partnership reports the following items

Q101: The AB,BC,and CD Partnerships merge into the

Q114: Which of the following is deductible as