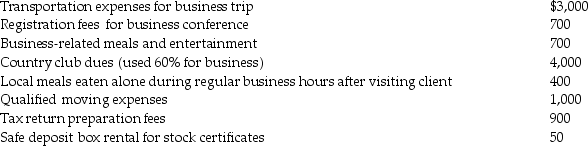

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Discounted Note

A promissory note or bond sold at a price lower than its face value, which will pay the face value at maturity.

Adjusting Entry

A journal entry made at the end of an accounting period to allocate income and expenditure to the correct period.

Interest Income

Income earned from investments, savings, or credit extended, such as interest on bonds, savings accounts, or loans provided to others.

Interest Accrued

The amount of interest that has been earned or incurred but has not yet been paid or received.

Q1: Identify which of the following statements is

Q6: Martin Corporation granted a nonqualified stock option

Q9: Identify which of the following statements is

Q12: Can a partner recognize both a gain

Q14: Patrick's records for the current year contain

Q39: Dighi,an artist,uses a room in his home

Q51: Identify which of the following statements is

Q74: As part of a plan of corporate

Q84: The total bases of all distributed property

Q100: Elijah contributes securities with a $90,000 FMV