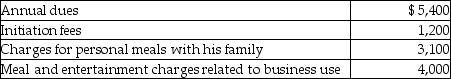

Joe is a self-employed tax attorney who frequently entertains his clients at his country club.Joe's club expenses include the following:  Assuming the business meals and entertainment qualify as deductible entertainment expenses,Joe may deduct

Assuming the business meals and entertainment qualify as deductible entertainment expenses,Joe may deduct

Definitions:

Genetic Map

A chart that shows the relative positions of genes and genetic markers on a chromosome based on the frequency of recombination between markers.

Genetic Counseling

A service that provides individuals and families with information on the nature, inheritance, and implications of genetic disorders to help them make informed medical and personal decisions.

BRCA Analysis

Genetic testing that checks for mutations in the BRCA1 and BRCA2 genes, known to increase the risk of breast and ovarian cancers.

Genetic Disorder

A condition caused by abnormalities in an individual's DNA, often resulting in disease or variations in development.

Q1: The basis of an asset must be

Q34: J.R.acquires an oil and gas property interest

Q56: Determine the net deductible casualty loss on

Q76: On August 11,2014,Nancy acquired and placed into

Q82: A taxpayer's tax year must coincide with

Q96: A loss incurred on the sale or

Q96: A partner's basis for his partnership interest

Q99: Jana reports the following income and loss:

Q99: Taxable acquisition transactions can either be a

Q112: For purposes of applying the passive loss