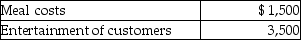

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

Experiment

A scientific procedure undertaken to make a discovery, test a hypothesis, or demonstrate a known fact through controlled conditions and variables.

Population

The total number of inhabitants constituting a particular race, class, or group in a specified area.

Attitudes

A psychological tendency expressed by evaluating a particular entity with some degree of favor or disfavor.

Drinking

The act of consuming liquids, often specifically referring to the consumption of alcoholic beverages.

Q1: Why would an acquiring corporation want an

Q4: The acquiring corporation does not obtain the

Q36: A net operating loss can be carried

Q45: What is the significance of the Thor

Q47: Vector Corporation has been using an incorrect

Q54: Identify which of the following statements is

Q64: A closely held C Corporation's passive losses

Q98: Tom and Shawn own all of the

Q98: Acquiring Corporation acquires at the close of

Q105: A partner's "distributive share" is the partner's