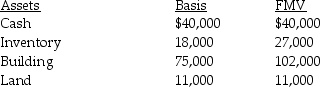

David sells his one-third partnership interest to Diana for $60,000 when his basis in the partnership interest is $48,000.On the date of sale,the partnership has no liabilities and the following assets:

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

Definitions:

Goal

An objective or desired result that a person or a system envisions, plans, and commits to achieve.

Compounded Semi-annually

A method of calculating interest in which interest is compounded to the principal amount semi-annually.

Quarterly Payments

Payments made four times a year at three-month intervals.

Investment Trusts

Collective investment schemes that pool money from investors to purchase a diversified portfolio of assets.

Q2: Identify which of the following statements is

Q21: David sells his one-third partnership interest to

Q38: For an S corporation to elect to

Q41: A partnership must file Form 1065 only

Q41: Damitria transfers her rights in a $100,000

Q64: Jason funds an irrevocable trust with Liberty

Q66: Identify which of the following statements is

Q69: Shanghai Corporation was organized and elected S

Q84: With respect to residential rental property<br>A)80% or

Q91: Steve sells his 20% partnership interest having