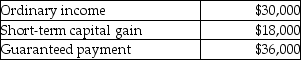

Brent is a general partner in BC Partnership.His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

Definitions:

Activity Levels

Describes the overall amount of physical and mental action or engagement displayed by an individual.

Genotype

The genetic form, or constitution, of a person as determined by heredity.

Monozygotic Twins

Twins that are genetically identical, resulting from the division of a single fertilized egg into two.

Dizygotic Twins

Dizygotic twins, also known as fraternal twins, are two offspring that result from the simultaneous fertilization of two different eggs by two different sperm, leading to genetically distinct siblings.

Q5: Identify which of the following statements is

Q14: Identify which of the following statements is

Q30: In-home office expenses which are not deductible

Q48: Identify which of the following statements is

Q60: Formation of a partnership requires legal documentation

Q61: Hannah is a 52-year-old an unmarried taxpayer

Q64: Last year,Cara contributed investment land with an

Q72: Electing large partnership rules differ from other

Q85: Broom Corporation transfers assets with an adjusted

Q87: On November 30,Teri received a current distribution