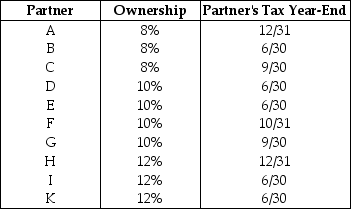

The XYZ Partnership is held by ten partners who have the following capital and profits ownership of the partnership.The tax year-end used by each of the ten partners is also indicated.Assume each partner has used this year-end for at least five years.

What is the required year-end for the XYZ Partnership,assuming that the business has no natural business year and has not filed a Sec.444 election?

What is the required year-end for the XYZ Partnership,assuming that the business has no natural business year and has not filed a Sec.444 election?

Definitions:

Threshold Potential

Neuron membrane potential at which voltage-gated sodium channels open, causing an action potential to occur.

Membrane Potential

The electrical potential difference across a cell's plasma membrane, crucial for transmission of nerve impulses and muscle contraction.

Neurotransmitter-Response

The reaction of a cell to the binding of neurotransmitters, which can alter the cell's activity or provoke a series of cellular events.

Skeletal Muscle Contraction

The process by which skeletal muscles, attached to bones, produce movement through the shortening of muscle fibers, using ATP as energy.

Q4: If an S corporation inadvertently terminates its

Q8: On January 1,2014,Charlie Corporation acquires all of

Q14: Jamie sells investment real estate for $80,000,resulting

Q18: Under the MACRS system,if the aggregate basis

Q25: Lloyd Corporation,a calendar year accrual basis taxpayer,pays

Q36: All of the following are true except:<br>A)A

Q38: Edward owns a 70% interest in the

Q42: Atiqa took out of service and sold

Q85: All of the following characteristics are true

Q89: Penish and Sagen Corporations have filed consolidated