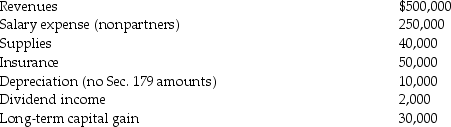

AT Pet Spa is a partnership owned equally by Travis and Ashley.The partnership had the following revenues and expenses this year.Which of the following items are separately stated? Nonseparately stated? What is each partner's distributive share of ordinary income?

Definitions:

Oil and Gas

Natural resources found beneath the Earth's surface, used as crucial energy sources and raw materials in various industries.

Rising Salt Dome

A geological formation where a column of salt moves upward through overlying sediments, often forming a dome-like structure.

Fault Zone

A fault zone is a region of the Earth's crust characterized by one or more faults, which are fractures along which there has been displacement of the sides relative to one another.

Unconformity

A surface within the rock record that represents a gap in the geological history due to erosion or non-deposition of sediments.

Q30: Explain the difference between partnership distributions and

Q32: Ron is a university professor who accepts

Q41: Ross works for Houston Corporation,which has a

Q49: On December 31,Kate sells her 20% interest

Q67: Prithi acquired and placed in service $190,000

Q71: Identify which of the following statements is

Q79: The installment method is not applicable to

Q85: Jerry has a $50,000 basis for his

Q87: Dues paid to social or athletic clubs

Q95: Misha,a single taxpayer,died on July 31,2014.Her final