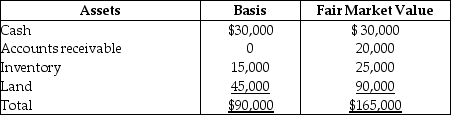

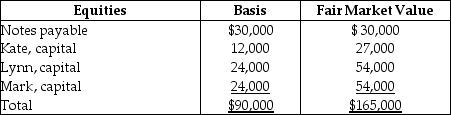

On December 31,Kate sells her 20% interest (with a basis of $18,000 which,of course,includes a share of partnership liabilities)in the KLM Partnership to Karl for $27,000 cash plus assumption of her $6,000 share of liabilities.On that date,the partnership has the following balance sheet:

What are the amount and character of the gain that Kate must recognize on the sale?

What are the amount and character of the gain that Kate must recognize on the sale?

Definitions:

Informational Influence

A form of social influence where a person conforms to the beliefs or behaviors of a group because they think the group has accurate information.

Charismatic Leadership

A style of leadership characterized by a leader's ability to inspire and motivate followers through their charm and persuasive personality.

Us-Versus-Them Philosophy

A mindset that divides the world into allies and enemies, fostering group solidarity at the expense of outsiders.

Economic Crisis

A situation characterized by a sudden and significant decline in the economy, leading to financial instability and hardship.

Q11: The maximum tax deductible contribution to a

Q19: H (age 50)and W (age 48)are married

Q22: If a cash basis taxpayer gives a

Q33: Tony sells his one-fourth interest in the

Q37: Chelsea,who is self-employed,drove her automobile a total

Q44: Cactus Corporation,an S Corporation,had accumulated earnings and

Q109: All taxpayers are allowed to contribute funds

Q114: Bob contributes cash of $40,000 and Carol

Q119: Which of the following is true about

Q131: Educational expenses incurred by a bookkeeper for