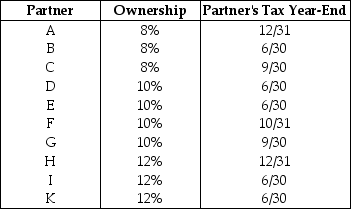

The XYZ Partnership is held by ten partners who have the following capital and profits ownership of the partnership.The tax year-end used by each of the ten partners is also indicated.Assume each partner has used this year-end for at least five years.

What is the required year-end for the XYZ Partnership,assuming that the business has no natural business year and has not filed a Sec.444 election?

What is the required year-end for the XYZ Partnership,assuming that the business has no natural business year and has not filed a Sec.444 election?

Definitions:

Work Sharing

Reducing the number of hours employees work to avoid layoffs when there is a reduction in normal business activity.

Management Objectives

Specific goals set by a management team to guide the operations and direction of a company or organization.

Compressed Workweek

An alternative work schedule in which employees work fewer than the normal five days a week but still put in a normal number of hours per week.

Peter Drucker

An Austrian-born American management consultant, educator, and author, whose writings contributed to the philosophical and practical foundations of the modern business corporation.

Q5: Sally is a calendar-year taxpayer who owns

Q25: Boxcar Corporation and Sidecar Corporation,an affiliated group,reports

Q31: ABC Partnership distributes $12,000 to partner Al.Al's

Q34: Which of the following statements regarding Health

Q59: Individual taxpayers can offset portfolio income with

Q65: When an involuntary conversion is due to

Q76: Which of the following intercompany transactions creates

Q80: Identify which of the following statements is

Q102: In computing the ordinary income of a

Q112: Feng,a single 40 year old lawyer,is covered