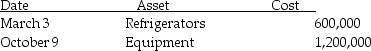

During the year 2014,a calendar year taxpayer,Marvelous Munchies,a chain of specialty food shops,purchased equipment as follows:

Assume the property is all 5-year property. What is the maximum depreciation that may be deducted for the assets this year,2014,assuming the alternative depreciation system is not chosen?

Assume the property is all 5-year property. What is the maximum depreciation that may be deducted for the assets this year,2014,assuming the alternative depreciation system is not chosen?

Definitions:

Long Run

A period in which all inputs, including capital assets, can be adjusted by firms in response to market conditions.

Unit of Account

A standard monetary unit of measurement of the market value/cost of goods, services, or assets.

Real Value

The value of an object or service adjusted for inflation, reflecting its true purchasing power.

Nominal Interest Rate

The interest rate stated on a loan or investment agreement, without adjustment for inflation.

Q21: If the threat of condemnation exists and

Q34: Lena owns a restaurant which was damaged

Q37: The STU Partnership,an electing Large Partnership,has no

Q57: When a taxpayer leases an automobile for

Q66: Marc is a calendar-year taxpayer who owns

Q82: Expenditures that enlarge a building,any elevator or

Q83: Jason,who lives in New Jersey,owns several apartment

Q86: In July of 2014,Pat acquired a new

Q110: What is required for an individual to

Q132: Deductible moving expenses include the cost of