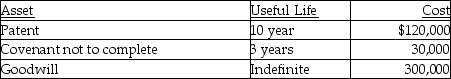

Stellar Corporation purchased all of the assets of Bellavia Company as of January 1 this year for $1 million. Included in the assets acquired are the following intangible assets:

What is Stellar's maximum amortization deduction for the year?

What is Stellar's maximum amortization deduction for the year?

Definitions:

Q16: Gena exchanges land held as an investment

Q44: Patricia exchanges office equipment with an adjusted

Q46: Under the cash method of accounting,all expenses

Q49: Ron obtained a new job and moved

Q53: Stephanie's building,which was used in her business,was

Q74: Ali,a contractor,builds an office building for a

Q90: An investor exchanges an office building located

Q91: Under the percentage of completion method,gross income

Q103: Luke's offshore drilling rig with a $700,000

Q131: Educational expenses incurred by a bookkeeper for