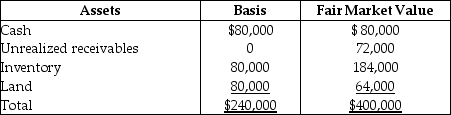

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What is the allocation of Tony's gain to the assets received?

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What is the allocation of Tony's gain to the assets received?

Definitions:

Q19: Tracy has a 25% profit interest and

Q28: Residential rental property is defined as property

Q40: Parent and Subsidiary Corporations are members of

Q75: Limited partners must consider the at-risk,basis,and passive

Q77: Gloria makes the following gifts during the

Q81: A corporation owns many acres of timber,which

Q89: The Vanity Corporation organized and began operations

Q98: Explain when educational expenses are deductible for

Q100: During the current year,George recognizes a $30,000

Q104: In year 1 a contractor agrees to