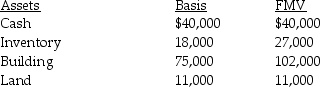

David sells his one-third partnership interest to Diana for $60,000 when his basis in the partnership interest is $48,000.On the date of sale,the partnership has no liabilities and the following assets:

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

Definitions:

Financial Statements

Reports that provide an overview of a company's financial condition, including balance sheet, income statement, and cash flow statement.

Extraordinary Gains

Unusual and infrequent gains that are reported separately from regular income because they result from events that are not part of the company's usual business activities.

Footnote Disclosure

Additional information provided at the bottom of financial statements, offering more detail on specific figures or accounting policies.

Statement of Retained Earnings

A financial statement that outlines the changes in a company's retained earnings over a specific period.

Q11: The maximum tax deductible contribution to a

Q30: In-home office expenses which are not deductible

Q42: If a partnership chooses to form an

Q49: On June 11,of last year,Derrick sold land

Q70: According to Sec.121,individuals who sell or exchange

Q70: Amounts paid in connection with the acquisition

Q86: Identify which of the following statements is

Q107: Joe is a self-employed tax attorney who

Q114: Ron's building,which was used in his business,was

Q120: What factors are considered in determining whether