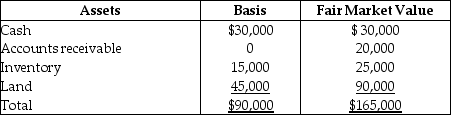

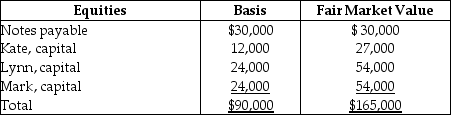

On December 31,Kate receives a $28,000 liquidating distribution from the KLM Partnership.On that date,Kate's basis in her limited partnership interest is $18,000 (which,of course,includes her share of partnership liabilities).The other partners assume her $6,000 share of liabilities.Just prior to the distribution,the partnership has the following balance sheet.Kate is leaving the partnership but the partnership is continuing.

What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

Definitions:

Expected Exam Scores

Expected Exam Scores refer to the anticipated performance or outcomes on academic assessments, often based on current knowledge, study habits, and historical performance.

Studying Economics

The discipline of learning about how societies use scarce resources to produce valuable commodities and distribute them among different people.

Studying Accounting

The process of learning about and understanding the theories, principles, and practices related to managing and reporting financial information.

Marginal Benefits

The extra advantage gained from a single unit rise in a specific action.

Q1: Sela sold a machine for $140,000.The machine

Q13: Everest Corp.acquires a machine (seven-year property)on January

Q33: Winnie made a $70,000 interest-free loan to

Q35: A consolidated return's tax liability is owed

Q43: Tessa owns an unincorporated manufacturing business.In 2014,she

Q48: Jerry has a 10% interest in the

Q79: Which of the following statements in not

Q105: The Tandy Partnership owns the following assets

Q108: Martin Corporation granted an incentive stock option

Q115: Brittany,who is an employee,drove her automobile a