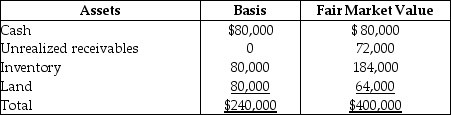

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What are the amount and character of Tony's gain?

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What are the amount and character of Tony's gain?

Definitions:

Workforce Creativity

The ability of employees to generate innovative ideas and solutions that can be applied to improve processes, products, or services within the workplace.

Diverse Populations

Groups of people with varying characteristics, backgrounds, cultures, and experiences, enriching a community or organization.

Values And Manages Diversity

Recognizes the importance of diversity and inclusivity in the workplace and actively promotes practices that respect and utilize differences.

Cross-cultural Leaders

Leaders who can effectively manage, lead, and motivate individuals from different cultural backgrounds, understanding and bridging cultural differences.

Q6: The purchase of a $15,000 engagement ring

Q16: Discuss the statutory exemptions from the gift

Q21: A consolidated NOL carryover is $52,000 at

Q30: Parent and Subsidiary Corporations form an affiliated

Q31: The exchange of a partnership interest for

Q58: Trusts that can own S corporation stock

Q67: This year,John purchased property from William by

Q78: Identify which of the following statements is

Q86: On the first day of the partnership's

Q89: Section 1250 does not apply to assets