Essay

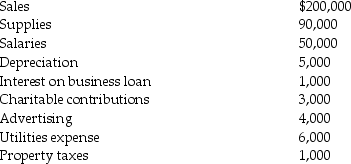

Connie's Restaurant has been an S corporation since it was formed in 2006.Its results for the previous year are as follows:

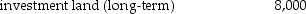

Gain on the sale of

Gain on the sale of

What are Connie's separately stated items? What is the S corporation's ordinary income?

What are Connie's separately stated items? What is the S corporation's ordinary income?

Grasp the concept of depth within organizational culture and the role of values.

Learn about the universal values emphasized in corporate cultures.

Understand the impact of countercultures on organizational ethical conduct and conflict.

Recognize the importance of enacted vs. espoused values in defining organizational culture.

Definitions:

Related Questions

Q28: Interest is not imputed on a gift

Q41: Natalie sold a machine for $140,000.The machine

Q50: Discuss the ways in which the estate

Q54: Jed sells an office building during the

Q55: Shamrock Corporation has two classes of common

Q65: The XYZ Partnership is held by ten

Q87: In January,Daryl and Louis form a partnership

Q90: Before receiving a liquidating distribution,Kathy's basis in

Q91: The value of stock that is not

Q97: Qualified tuition and related expenses eligible for