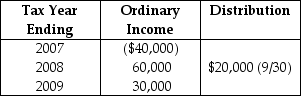

Robert Elk paid $100,000 for all of the single class of stock of Elkom Corporation,an electing S corporation,when incorporated in January,2007.Elkom's operating results and dividend distribution are as follows:

What is Elk's basis for his Elkom stock on December 31 of 2007?

What is Elk's basis for his Elkom stock on December 31 of 2007?

Definitions:

Equity Securities

Financial instruments that represent ownership in a company, such as stocks, entitling holders to dividends and capital gains.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or within the normal operating cycle of a business.

Debt Securities

Financial instruments representing money borrowed that must be repaid, often with interest, including bonds, bills, and notes.

Fair Value

The estimated price at which an asset can be bought or sold in a current transaction between willing parties.

Q7: Stan had a basis in his partnership

Q8: On January 1,2014,Charlie Corporation acquires all of

Q10: An exchange of inventory for inventory of

Q27: Unrecaptured 1250 gain is the amount of

Q33: Tony sells his one-fourth interest in the

Q41: A partnership must file Form 1065 only

Q62: If a partnership asset with a deferred

Q64: Brent is a general partner in BC

Q65: Calvin transfers land to a trust.Calvin retains

Q72: Identify which of the following statements is