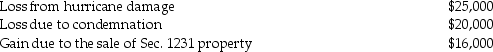

The following gains and losses pertain to Arnold's business assets that qualify as Sec.1231 property.Arnold does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Apolipoprotein ε4

A variant form of the apolipoprotein E protein, associated with increased risk of Alzheimer's disease and other health conditions.

Alzheimer's Disease

A progressive neurological disorder characterized by memory loss, cognitive decline, and personality changes.

Glucagon

A hormone secreted by the pancreas that stimulates the release of glucose, thus elevating blood sugar level.

Insulin Level

The concentration of insulin, a hormone produced by the pancreas to regulate blood glucose levels, present in the bloodstream.

Q15: Connie's Restaurant has been an S corporation

Q23: Tonya sold publicly-traded stock with an adjusted

Q40: Identify which of the following statements is

Q50: Andrew sold land to Becca,Andrew's daughter.The fair

Q61: Points paid on a mortgage to buy

Q69: Panther Trust has net accounting income and

Q87: Frisco Inc.,a C corporation,placed a building in

Q87: Hong earns $127,300 in her job as

Q103: Luke's offshore drilling rig with a $700,000

Q114: Bud and Stella are married,file a joint