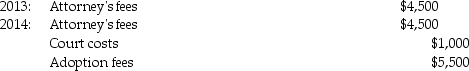

Tyler and Molly,who are married filing jointly with $210,000 of AGI in 2014,incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2014.What is the amount of the allowable adoption credit in 2014?

The adoption was finalized in 2014.What is the amount of the allowable adoption credit in 2014?

Definitions:

Evaluation

The systematic determination of a subject's merit, worth, and significance, using criteria governed by a set of standards.

Responsibility

The duty or obligation to perform or complete a task, often with an understanding of the moral, legal, or social consequences of failure to do so.

Conflict Resolution

The process of resolving a disagreement or dispute between parties in a constructive manner.

Negotiation

A dialogue between two or more people or parties intended to reach a beneficial outcome over one or more issues where conflict exists.

Q3: Explain why living trusts are popular tax-planning

Q36: All of the following are true except:<br>A)A

Q45: The estate tax return is due,ignoring extensions,3-1/2

Q51: What is the IRS guideline for determining

Q55: Organizational expenditures include all of the following

Q59: On July 25 of the following year,Joy

Q77: If the U.S.Supreme Court decides to hear

Q83: Pablo,a bachelor,owes $80,000 of additional taxes,all due

Q98: Medical expenses in excess of 10% of

Q99: Identify which of the following statements is