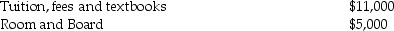

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2014:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Annual Dividend

The total dividend payments a company makes to its shareholders in a year, often expressed as a payment per share.

Market Rate of Return

The average rate of return of a specific market or investment over a certain period, reflecting the gains and losses in that market.

Annual Dividend

The total dividend payment a shareholder receives from a company in one year, based on the number of shares owned.

Constant

A value that does not change and remains fixed throughout the calculation or equation in which it appears.

Q10: A substantial understatement of tax liability involves

Q14: How does the IRS regulate the activities

Q23: On July 1,Frank loans his brother Matt

Q38: Cassie owns a Rembrandt painting she acquired

Q43: For purposes of the limitation on qualifying

Q66: Hu makes a gift of his home

Q75: You have the following citation: Joel Munro,92

Q75: Olivia exchanges land with a $50,000 basis

Q76: Dallas Corporation,not a dealer in securities,realizes taxable

Q109: A revenue ruling is issued by the