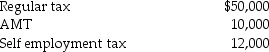

Beth and Jay project the following taxes for the current year:

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

How much in estimated tax payments (including withholding from wages and quarterly estimated payments)should the taxpayers pay this year in order to avoid underpayment penalties under the following assumptions regarding the preceding tax year?

a.Preceding tax year-AGI of $140,000 and total taxes of $36,000.

b.Preceding tax year-AGI of $155,000 and total taxes of $50,000.

Definitions:

Net Worth

The total assets minus total outside liabilities of an individual or a company, representing the financial position at a given moment.

Proxy Solicitation

The process of obtaining authority to vote on behalf of shareholders.

Securities and Exchange Commission

A U.S. government agency that oversees securities transactions, activities of financial professionals, and maintains fair and orderly functioning of the securities markets.

Insider Trading

The illegal buying or selling of a publicly-traded company's stock by someone who has non-public, material information about that stock.

Q5: Which of the following is not a

Q11: Marinda exchanges an office building worth $800,000

Q18: Nikki exchanges property having a $20,000 adjusted

Q25: A owns a ranch in Wyoming,which B

Q35: The following gains and losses pertain to

Q37: Identify which of the following statements is

Q46: In 2014,the unified credit enables an estate

Q64: Identify which of the following statements is

Q77: Which of the following communications between an

Q103: Which of the following is not a