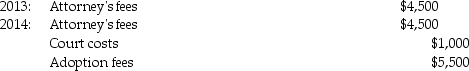

Tyler and Molly,who are married filing jointly with $210,000 of AGI in 2014,incurred the following expenses in their efforts to adopt a child:

The adoption was finalized in 2014.What is the amount of the allowable adoption credit in 2014?

The adoption was finalized in 2014.What is the amount of the allowable adoption credit in 2014?

Definitions:

Operating Activities

Activities that relate directly to the primary operations of a company, such as manufacturing, distributing, marketing, and selling a product or service.

Direct

Pertains to costs or actions that can be directly attributed to a specific project, department, or product without any need for allocation.

Indirect Methods

Approaches used in accounting and finance to estimate or calculate values based on indirect indicators or conversions, rather than direct measurement.

Three Sources

Refers to the original means or origins of information, funds, or support, often used in various contexts.

Q7: Installment sales of depreciable property which result

Q20: The maximum amount of the American Opportunity

Q23: Identify which of the following statements is

Q37: Phil and Nick form Philnick Corporation.Phil exchanges

Q48: In 2002,Gert made a $5,000,000 taxable gift.The

Q55: If an individual transfers an ongoing business

Q63: An automatic extension of time from the

Q67: Ra Corporation issues a twenty-year obligation at

Q71: A net Sec.1231 gain is treated as

Q98: In which courts may litigation dealing with