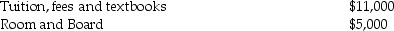

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2014:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Definitions:

Equal End-of-Year

A term referring to payments or allocations that are made uniformly at the end of each year.

Effective Annual Rate

The effective annual rate (EAR) is the interest rate on a financial product restated from nominal terms into an annualized rate accounting for compounding over a period.

Loan Contract

A legally binding agreement between a borrower and a lender that outlines the terms and conditions of a loan.

Interest Payments

Regular payments made to lenders or bondholders as compensation for the use of borrowed funds, usually calculated as a percentage of the principal.

Q19: In 2001,Alejandro buys an annuity for $100,000

Q33: Texas Trust receives $10,000 interest on U.S.Treasury

Q33: Administrative expenses are not deductible on the

Q43: If a principal residence is sold before

Q51: In 2014,Thomas,who has a marginal tax rate

Q65: In 2014 Rita is divorced with one

Q84: Explain accountant-client privilege.What are the similarities and

Q87: Identify which of the following statements is

Q99: Identify which of the following statements is

Q115: In 2014 Charlton and Cindy have alternative