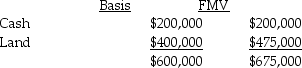

Sean,Penelope,and Juan formed the SPJ partnership by each contributing assets with a basis and fair market value of $200,000.In the following year,Penelope sold her one-third interest to Pedro for $225,000.At the time of the sale,the SPJ partnership had the following balance sheet:

Shortly after Pedro became a partner,SPJ sold the land for $475,000.What are the tax consequences of the sale to Pedro and the partnership (1)assuming there is no Section 754 election in place,and (2)assuming the partnership has a valid Section 754 election?

Shortly after Pedro became a partner,SPJ sold the land for $475,000.What are the tax consequences of the sale to Pedro and the partnership (1)assuming there is no Section 754 election in place,and (2)assuming the partnership has a valid Section 754 election?

Definitions:

Securities and Exchange Commission

A U.S. federal agency responsible for enforcing federal securities laws, regulating the securities industry, and overseeing the nation’s stock and options exchanges.

Accounting Principles

Guidelines and rules that govern the accounting and financial reporting practices of businesses, ensuring consistency, reliability, and comparability of financial statements.

Conservatism

An accounting principle that advises caution, directing accountants to choose methods and estimates that are least likely to overstate assets and income.

Fair Value Accounting

An accounting approach that measures and reports assets and liabilities at their estimated market prices.

Q8: Apple Corporation and Banana Corporation file consolidated

Q10: An automatic extension of time from the

Q20: A trust reports the following results:<br> <img

Q43: Briefly discuss some of the reasons for

Q44: P-S is an affiliated group that files

Q48: Texas Corporation is undergoing a complete liquidation

Q54: Dexer Corporation is owned 70% by Amy

Q55: Carol owns Target Corporation stock having an

Q81: A plan of liquidation<br>A)must be written.<br>B)details the

Q100: An S corporation is not treated as