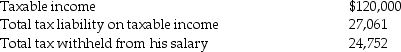

Frederick failed to file his 2012 tax return on a timely basis.In fact,he filed his 2012 income tax return on October 31,2013,(the due date was April 15,2013)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2012 return:

Frederick sent a check for $2,309 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2012.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $2,309 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2012.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Net Realizable Value

The projected sales price of products subtracted by the cost associated with their sale or disposal.

Merchandise

Goods that are bought and sold by businesses; also refers to the commodities or products available for sale in retail or wholesale.

Total Value

The entire worth of an asset, portfolio, or company, factoring in all components of value.

Perpetual Inventory System

An inventory management system that updates inventory records for each purchase and sale transaction in real-time.

Q15: The Cable TV Company,an accrual basis taxpayer,allows

Q28: Identify which of the following statements is

Q42: David,age 62,retires and receives $1,000 per month

Q48: This year,Jason sold some qualified small business

Q50: Tina,whose marginal tax rate is 33%,has the

Q61: Identify which of the following statements is

Q66: Brad owns 100 shares of AAA Corporation

Q68: Adanya's marginal tax rate is 39.6% and

Q86: If a capital asset held for one

Q121: Under the terms of their divorce agreement