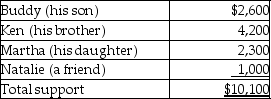

Blaine Greer lives alone.His support comes from the following sources:  Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?

Assuming a multiple support declaration exists,which of the individuals may claim Blaine as a dependent?

Definitions:

Investment Account

An account held at a financial institution that is used to buy, hold, and sell various investment securities like stocks, bonds, and mutual funds.

New Shares

Shares issued by a company for the first time to the public or existing shareholders as part of a capital raising or expansion strategy.

Consolidated Net Income

The total net income of a parent company and all its subsidiaries, after eliminating inter-company transactions and dividends received from the subsidiaries.

Noncontrolling Interest

A minority stake in a company, held by investors or other companies that do not have control over business operations.

Q3: In the year of termination,a trust incurs

Q9: Each year a taxpayer must include in

Q18: In January of the current year,Stan Signowski's

Q32: In general,if a life insurance policy is

Q36: The following items were discovered in reviewing

Q40: What is the requirement for a substantial

Q69: Latka Novatny gave you the following information

Q72: Gross income is income from whatever source

Q81: Generally,deductions for adjusted gross income on an

Q100: Mike,a dealer in securities and calendar-year taxpayer,purchased