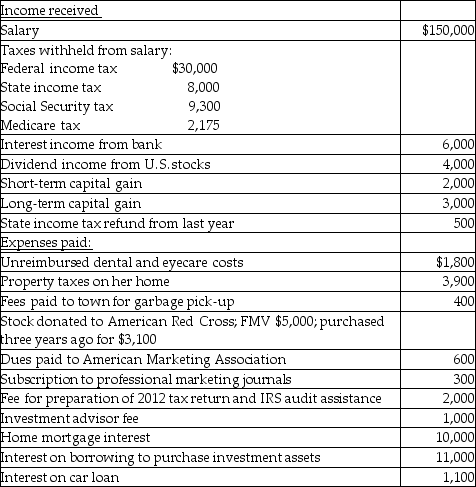

Hope is a marketing manager at a local company.Information about her 2013 income and expenses is as follows:

Compute Hope's taxable income for the year in good form.Show all supporting computations.Hope is single,and she elects to itemize her deductions each year.Assume she does not make any elections regarding the investment interest expense.Also assume that her tax profile was similar in the preceding year.

Compute Hope's taxable income for the year in good form.Show all supporting computations.Hope is single,and she elects to itemize her deductions each year.Assume she does not make any elections regarding the investment interest expense.Also assume that her tax profile was similar in the preceding year.

Definitions:

Real Interest Rate

The interest rate recalibrated to factor in inflation, showcasing the real expense of borrowing or the legitimate profit from saving.

Nominal Interest Rate

The nominal interest rate, which reflects the raw rate of interest prior to being adjusted for inflation and represents the apparent value of financial dealings.

Market Basket

A selection of goods and services used to track price changes and inflation in an economy, representing the typical purchases made by consumers.

CPI

The Consumer Price Index, a measure that examines the weighted average of prices of a basket of consumer goods and services, used as an indicator of inflation.

Q2: On August 11,2013,Nancy acquired and placed into

Q10: Expenditures that enlarge a building,any elevator or

Q17: In the current year George,a college professor,acquired

Q35: If the principal reason for a taxpayer's

Q41: The basis of an asset must be

Q66: Once the business use of listed property

Q67: The look-back interest adjustment involves the<br>A)calculation of

Q75: Terra Corporation,a calendar-year taxpayer,purchases and places into

Q97: Ron obtained a new job and moved

Q98: Bart operates a sole proprietorship for which