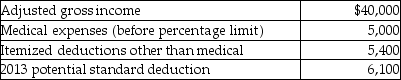

A review of the 2013 tax file of Gregory,a single taxpayer who is age 40,provides the following information regarding Gregory's 2013 tax status:  In 2014,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

In 2014,Gregory receives a reimbursement for last year's medical expenses of $1,200.As a result,Gregory must

Definitions:

Cornea

The transparent front part of the eye that covers the iris, pupil, and anterior chamber, contributing most of the eye's focusing power.

Transparent Structure

A system or organization in which the operational processes, decisions, and principles are made clear and accessible to its members or the public.

Additive Colour Mixing

The process of creating new colors by mixing different colors of light, with primary colors typically being red, green, and blue.

Spotlights

Focused beams of light used to illuminate a specific area or object, commonly employed in performances or presentations to draw attention.

Q2: Explain how tax planning may allow a

Q13: Sam received a scholarship for room and

Q47: Michelle purchased her home for $150,000,and subsequently

Q51: Which of the following statements regarding Sec.179

Q83: Becky,a single individual,reports the following taxable items

Q85: Martina,who has been employed by the Smythe

Q87: Child support is<br>A)deductible by both the payor

Q91: Mike sold the following shares of stock

Q116: When are home-office expenses deductible?

Q128: If property received as a gift has