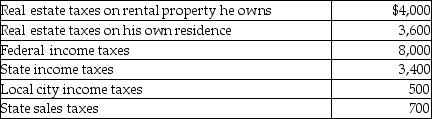

Matt paid the following taxes:  What amount can Matt deduct as an itemized deduction on his tax return?

What amount can Matt deduct as an itemized deduction on his tax return?

Definitions:

Wikipedia

A free online encyclopedia that allows its users to edit almost any article accessible, aiming to provide a comprehensive and collaboratively established source of information.

Research Papers

Extended essays or studies written by students or scholars that present their findings on a particular topic following thorough investigation.

Library

A collection or group of collections of books and/or other print or nonprint materials organized and maintained for use (reading, consultation, study, research, etc.).

Research Projects

Structured academic or scientific endeavors undertaken to investigate a specific hypothesis or question, often resulting in new knowledge or insights.

Q6: Expenses paid with a credit card are

Q10: Erin's records reflect the following information: 1.Paid

Q28: On Form 1040,deductions for adjusted gross income

Q37: In the current year,ABC Corporation had the

Q44: Gina owns 100 shares of XYZ common

Q65: Losses incurred on wash sales of stock

Q73: Mr.and Mrs.Gere,who are filing a joint return,have

Q103: Which of the following statements is false?<br>A)A

Q110: Tessa is a self-employed CPA whose 2013

Q116: When are home-office expenses deductible?