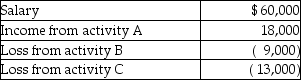

Nancy reports the following income and loss in the current year.  All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

Definitions:

Strategic Items

Products or components critical to a company's competitive position and operational performance.

Availability

The degree to which a product, service, or resource is obtainable or accessible.

General Items

Products or commodities that are basic and nondescript, typically stocked regularly.

Critical Items

Items that are essential for the production process or meet customer demands, where their absence can significantly impact operations.

Q10: Expenditures that enlarge a building,any elevator or

Q16: Because of the locked-in effect,high capital gains

Q20: Dues paid to social or athletic clubs

Q30: Taxpayers may deduct lobbying expenses incurred to

Q48: Vera has a key supplier for her

Q49: Ben is a well-known professional football quarterback.His

Q72: Kelly was sent by her employer to

Q82: The mid-quarter convention applies to personal and

Q85: Sharif is planning to buy a new

Q88: Lincoln purchases nonresidential real property costing $300,000