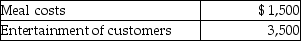

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the different dinners.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the different dinners.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

SWOT Analysis

A strategic planning tool that identifies and evaluates the Strengths, Weaknesses, Opportunities, and Threats related to a project or business.

Capital Investments

Funds invested in a company or project for the purpose of furthering its business objectives, typically in physical assets like buildings or machinery.

Competitive Environment

describes the external factors that affect a firm's ability to compete in the market, including the number and capability of competitors.

Philanthropy

The act of donating money, goods, services, and time to support causes beneficial to the public good, often aimed at improving welfare and quality of life.

Q13: In lieu of a foreign tax credit,a

Q20: Shaunda has AGI of $90,000 and owns

Q32: Mitchell and Debbie,both 55 years old and

Q76: In 2013,Richard's Department Store changes its inventory

Q85: Under the cash method of accounting,all of

Q90: Jack takes a $7,000 distribution from his

Q94: If property is involuntarily converted into similar

Q113: During 2013,Marcia,who is single and is covered

Q115: An expense is considered necessary if it

Q128: Ron is a university professor who accepts