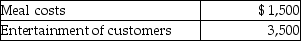

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the different dinners.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the different dinners.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

Pre-Treatment

A stage or activities that occur before the commencement of a primary treatment, often involving assessment or preparatory interventions.

Abstinence Violation

A concept in addiction recovery that refers to a person's sense of failure or guilt after breaking a commitment to abstain from substance use or certain behaviors.

The Wall

A metaphorical expression often used to describe a significant obstacle or a point of extreme mental or physical exhaustion that one feels unable to overcome.

Distal Risks

Factors that are not immediately linked to an outcome but can contribute to its likelihood over time, often through a chain of intermediary influences.

Q7: Frank loaned Emma $5,000 in 2011 with

Q8: Freida is an accrual-basis taxpayer who owns

Q71: Interest expense incurred in the taxpayer's trade

Q73: A taxpayer owns an economic interest in

Q78: A business bad debt gives rise to

Q95: Jordan paid $30,000 for equipment two years

Q96: The involuntary conversion provisions which allow deferral

Q103: On May 18,of last year,Yuji sold unlisted

Q106: Qualified residence interest consists of both acquisition

Q117: Andrea died with an unused capital loss