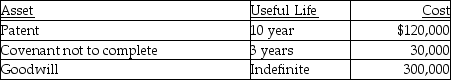

Stellar Corporation purchased all of the assets of Bellavia Company as of January 1 this year for $1 million.Included in the assets acquired are the following intangible assets:

What is Stellar's maximum amortization deduction for the year?

What is Stellar's maximum amortization deduction for the year?

Definitions:

Cesarean Section

A surgical procedure used to deliver a baby through incisions in the abdomen and uterus, often used when vaginal delivery would pose a risk to the mother or baby.

Precipitous Labor

Labor that progresses very quickly, often resulting in childbirth in less than three hours from the onset of contractions.

Contractions

The tightening and shortening of muscles, often referring to those of the uterus during labor.

Fetal Presentation

The position a fetus is in, in relation to the birth canal, during delivery. Common presentations include cephalic (head first), breech (feet or buttocks first), and shoulder.

Q6: Discuss the rules regarding the holding period

Q44: Many taxpayers use the LIFO method of

Q48: Taxpayers may elect to include net capital

Q56: Tasneem,a single taxpayer has paid the following

Q57: Stacy,who is married and sole shareholder of

Q70: A revenue ruling is issued by the

Q70: Nick sells land with a $7,000 adjusted

Q72: Marvin and Pamela are married,file a joint

Q81: A net operating loss can be carried

Q96: Individuals without children are eligible for the