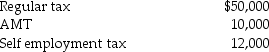

Beth and Jay project the following taxes for the current year:

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

In order to avoid underpayment penalties,between withholding from wages and quarterly estimated payments,Beth and Jay should pay in at least (assume the following prior year amounts):

a.AGI of $140,000 and total taxes of $36,000.

b.AGI of $155,000 and total taxes of $50,000.

Definitions:

Paraphilic Activities

Behavior involving unusual or abnormal sexual interests, but not necessarily implying dysfunction or criminality unless acted upon non-consensually.

Nonconsensual

Activities or actions carried out without the agreement or consent of one or more of the individuals involved.

Clinicians

Healthcare professionals who work directly with patients, diagnosing and treating diseases, injuries, and other physical and mental impairments.

Insurance Companies

Corporations that provide coverage, or reimbursement, to policyholders in the event of certain losses, sickness, or damage, in exchange for premium payments.

Q15: The earned income credit is available only

Q16: Section 1250 could convert a portion of

Q30: Intangible drilling and development costs (IDCs)may be

Q32: Many professional service partnerships have adopted the

Q39: Which statement is correct?<br>A)Tax credits reduce tax

Q42: Given that D<sub>n</sub> is the amount of

Q59: Harrison acquires $65,000 of 5-year property in

Q66: According to the Statements on Standards for

Q77: Trestle Corp.received $100,000 of dividend income from

Q109: A citator enables tax researchers to locate